Forecasting & Valuation

Effective forecasting requires an in-depth understanding of financial

modeling and the ability to collect and tie together multiple data

sources. Our experience as consultants, combined with our extensive

work in primary and secondary research, makes us well equipped for

the challenges of forecasting.

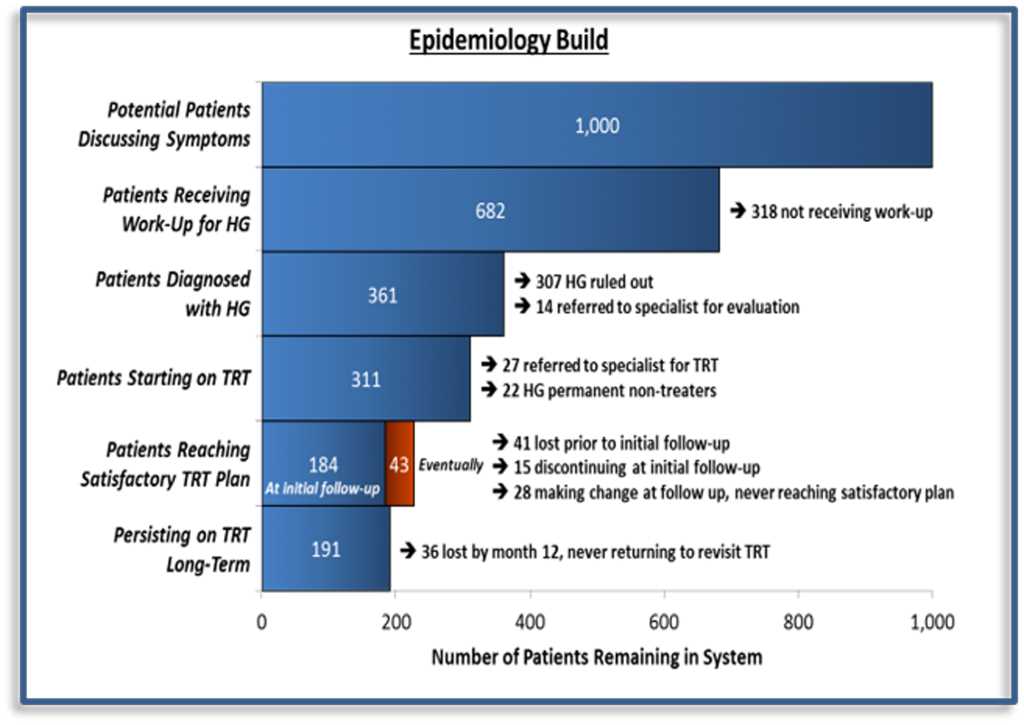

We begin our forecast projects by determining the data needed to

size the market and constructing the corresponding epidemiology

estimates – the foundation of a forecast model. We utilize

available secondary data and identify additional data points to

be captured through primary research, such as treatment rates

or patient persistence. Integrating the primary and secondary

data allows for a more complete and accurate view of the

potential market for a product.

Example: Components of an Epidemiology Estimate

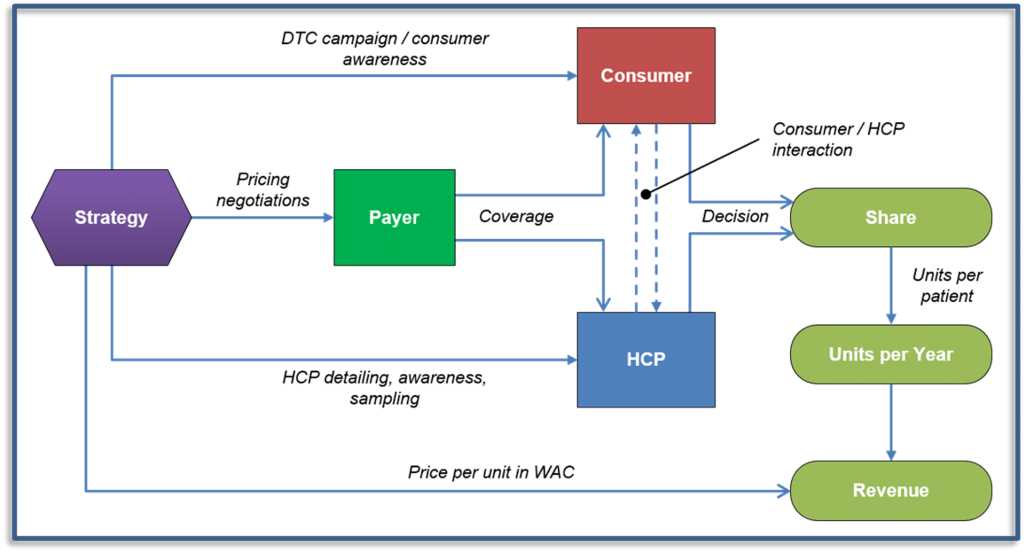

We also create an influence diagram to model how different stakeholders

interact and impact the target product’s sales. The diagram highlights

decisions and interactions that should be quantified through primary

research where possible.

Developing the epidemiology estimates and influence diagrams at the

start of the project, allows us to create efficient and targeted

research tools.

Example: Generalized Influenced Diagram for a Pharmaceutical Product

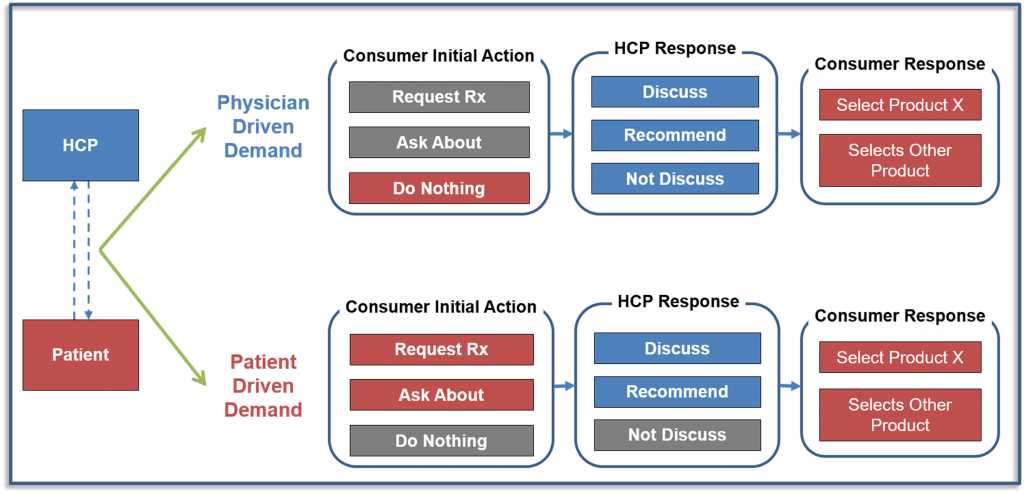

We look to use data from multiple sources or audiences to

effectively model the complex series of interactions and

influences that drive a product’s market share. We account for

various factors such as price sensitivity, potential prior

authorization constraints, and patients’ willingness to follow a

physician recommendation.

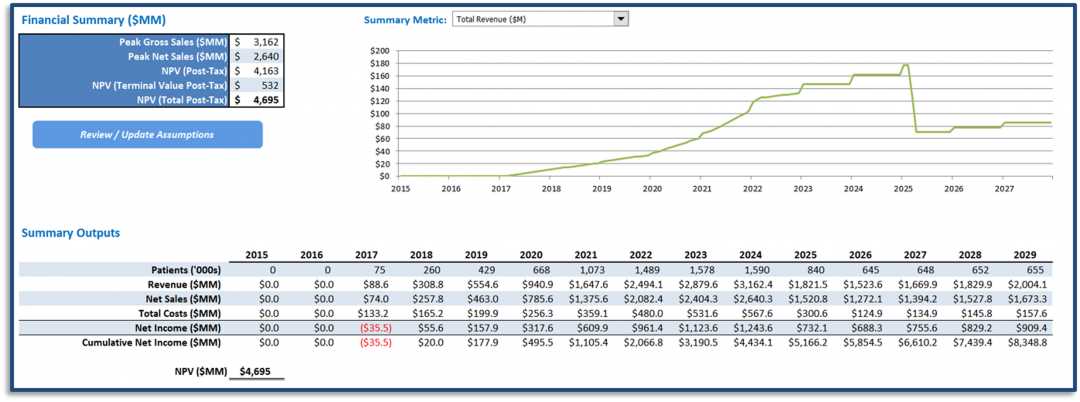

Next, we create the forecast model itself in Excel, often in

parallel with the fielding of primary research. The influence

diagram guides the structure of the forecast model and

establishes the various inputs and uncertainties the model must

accommodate.

Our forecast models are transparent and highly flexible so they

can be readily revised as information and assumptions change.

All of our forecast models are delivered in a user-friendly

Excel format with inputs and assumptions that can be varied buy

the user, allowing anyone to see the financial impact of

different assumptions or decisions.

Example: Modeling Patient – Physician Interactions to Predict Market Share

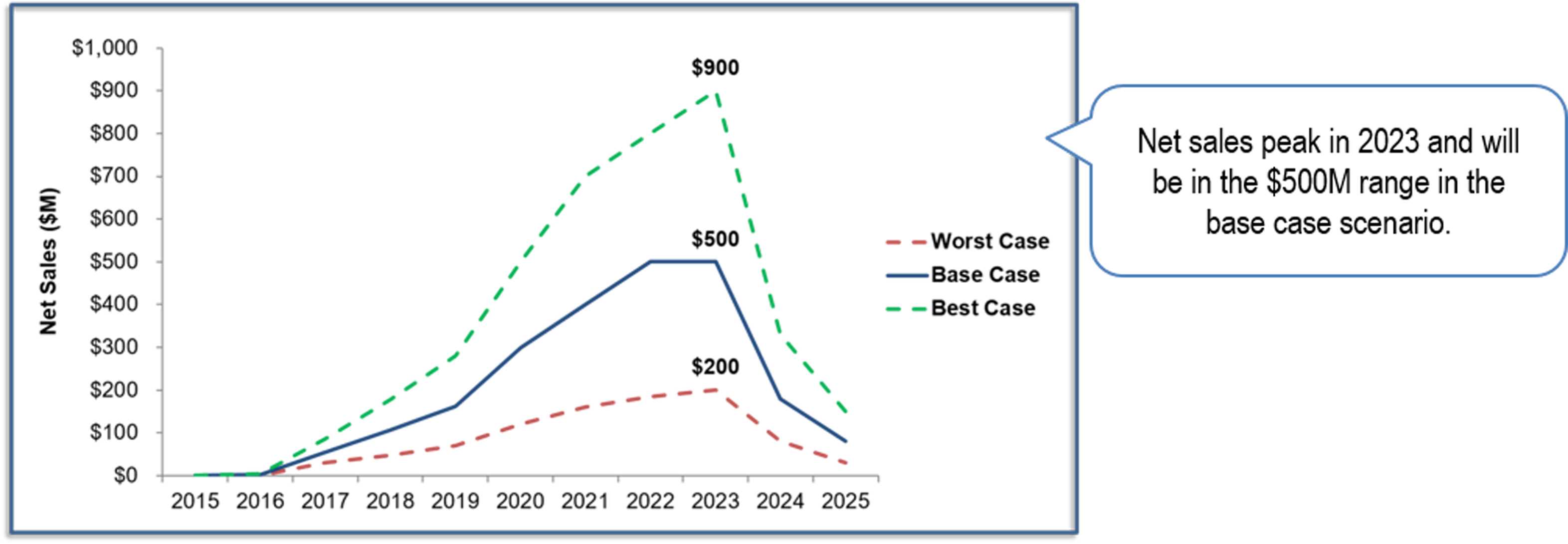

Our forecast models often incorporate key market events, such as

the entrance of new competitors, loss of exclusivity of existing

competitors, or additional indication, and utilize primary

research or secondary data proxies to project the impact on that

target product. We often also incorporate our client’s potential

market entry strategies, allowing them to play out different

strategies in different scenarios to understand when the

strategies would be most effective.

Example: Typical Forecast Model Output

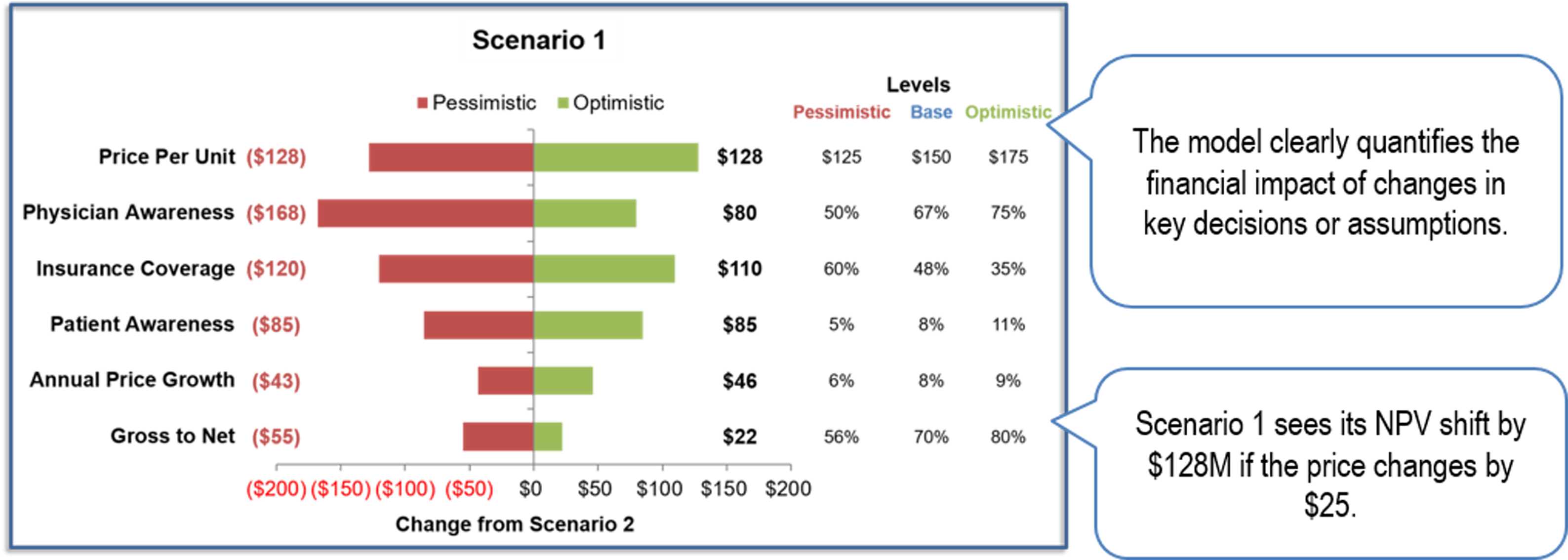

As part of our forecasting process, we conduct sensitivity and

risk analysis to understand how different assumptions or

decisions impact the overall financial performance. The analysis

highlights potential sources of risk as well as areas that may

warrant further research.

Example: NPV Sensitivity to Key Assumptions

Example: Net Sales Projections by Scenasrio

The combination of outputs and analyses, along with the team’s

ability to modify the forecast model to incorporate new or

changing data, enables us to make strategic recommendations and

equips our clients to make informed, financially sound

decisions.