Information Gathering

At I2, we do not attach ourselves to any single source of

information or methodology. This enables us to maintain a

superior level of transparency and objectivity. We pride

ourselves on offering the broadest set of primary market

research methodologies and over 20 years of expertise in

finding and using secondary data.

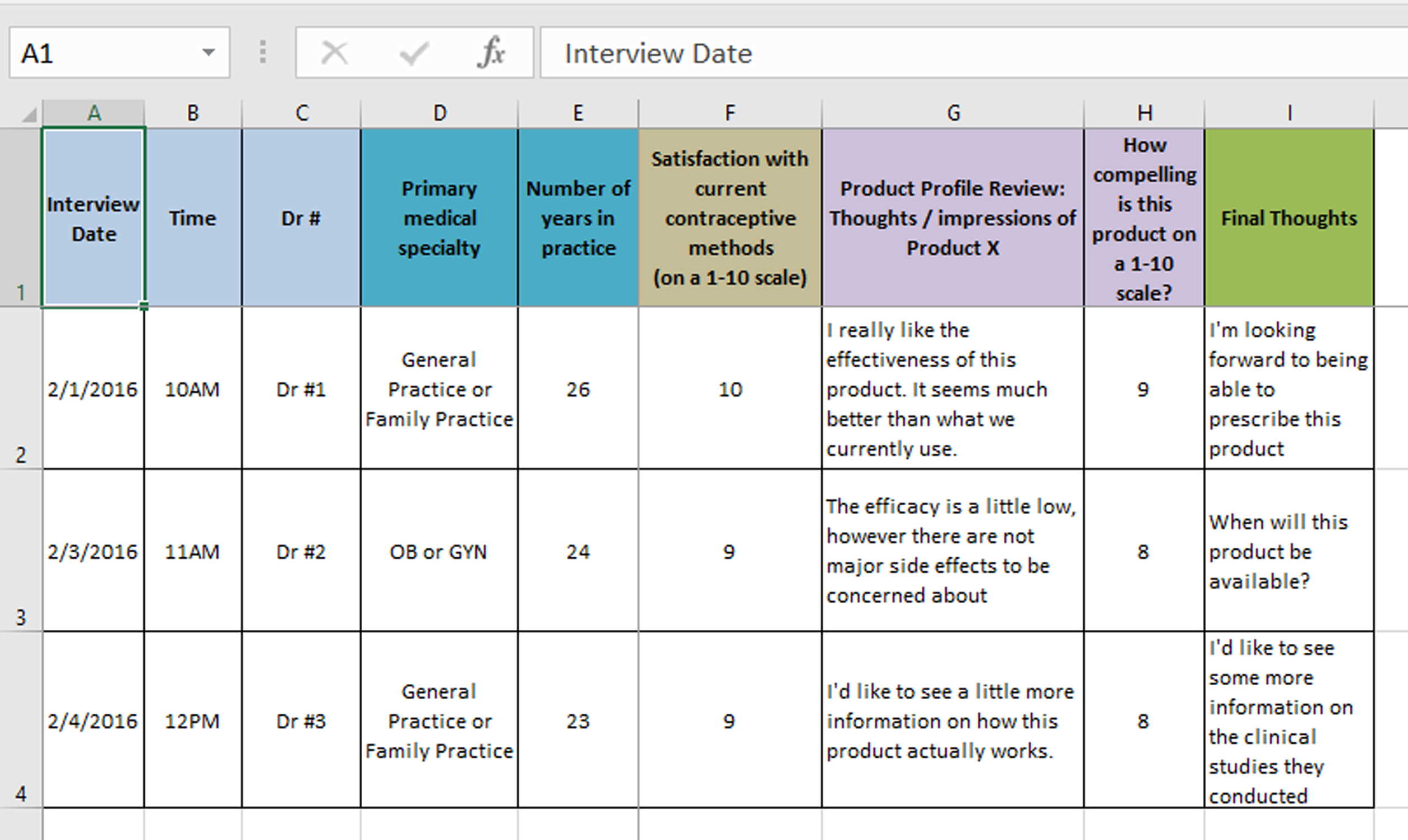

We ensure that every qualitative interview we conduct

is fully digested and transcribed into an Excel grid.

The grids include direct quotations from research

participants and all ticks and tallies collected

during the interview. These grids streamline the

analysis process and allow us to collate findings in

an efficient manner.

Example: Qualitative Interview Grid

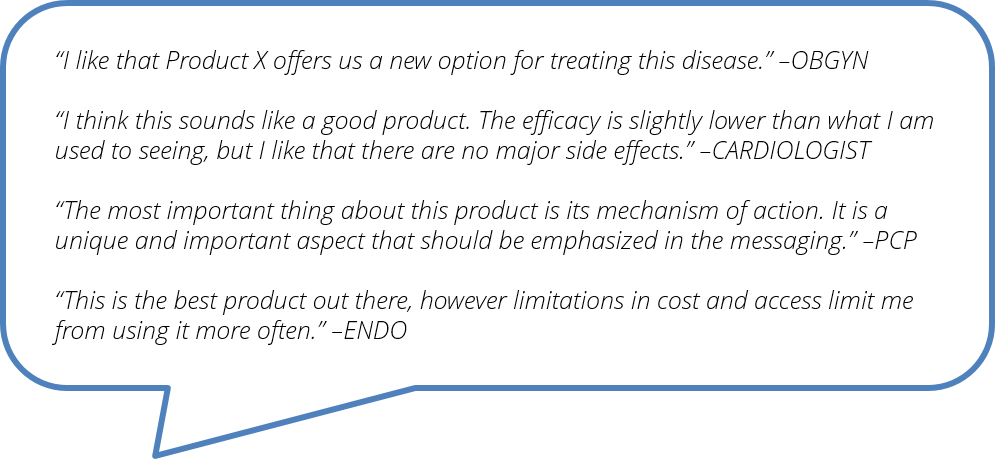

We also support all of our qualitative findings with

direct quotes from respondents. These quotes play an

integral role in our final reports and can be presented

via audio clips and/or in writing.

Example: Physician Interview Quotations

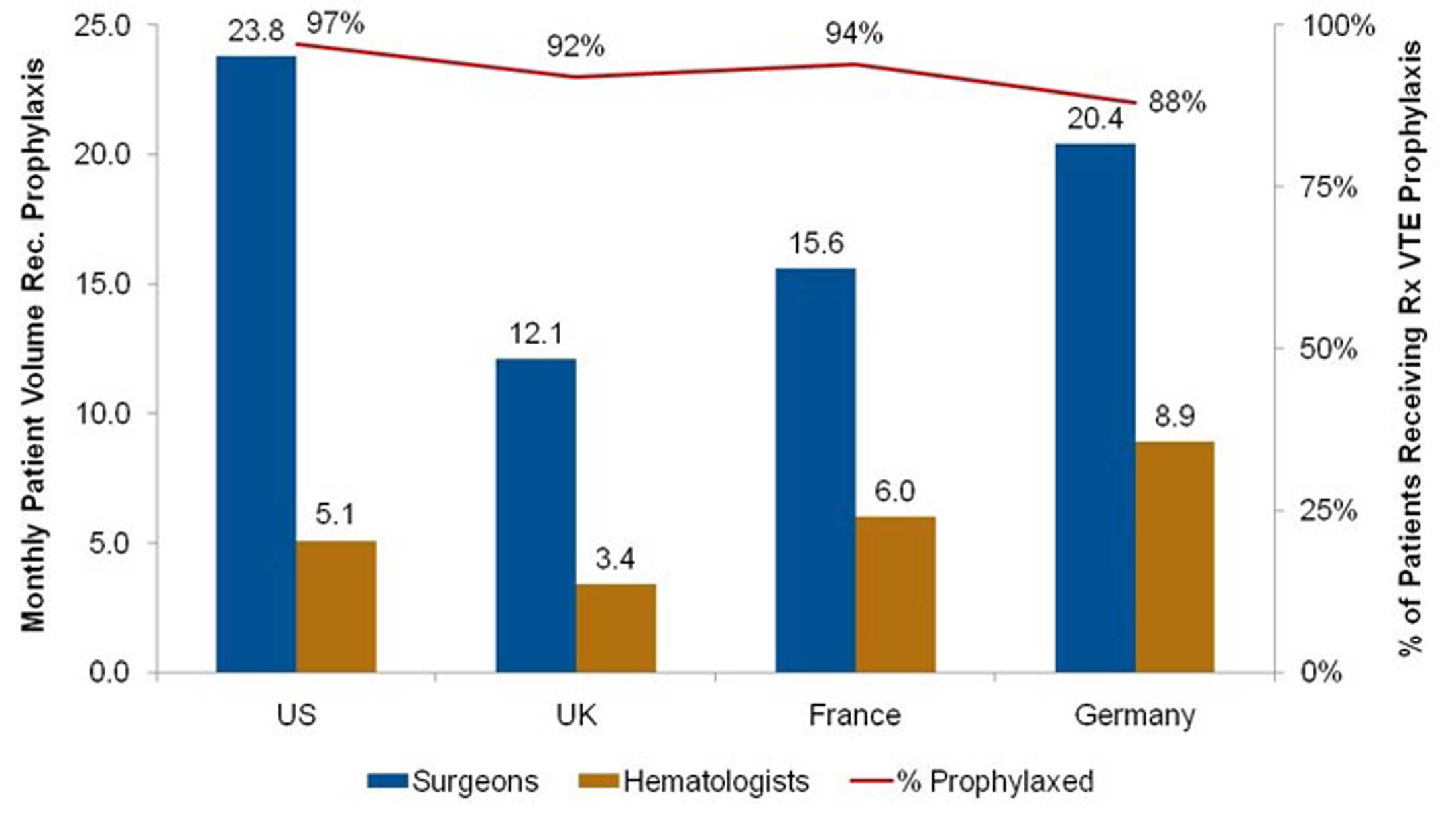

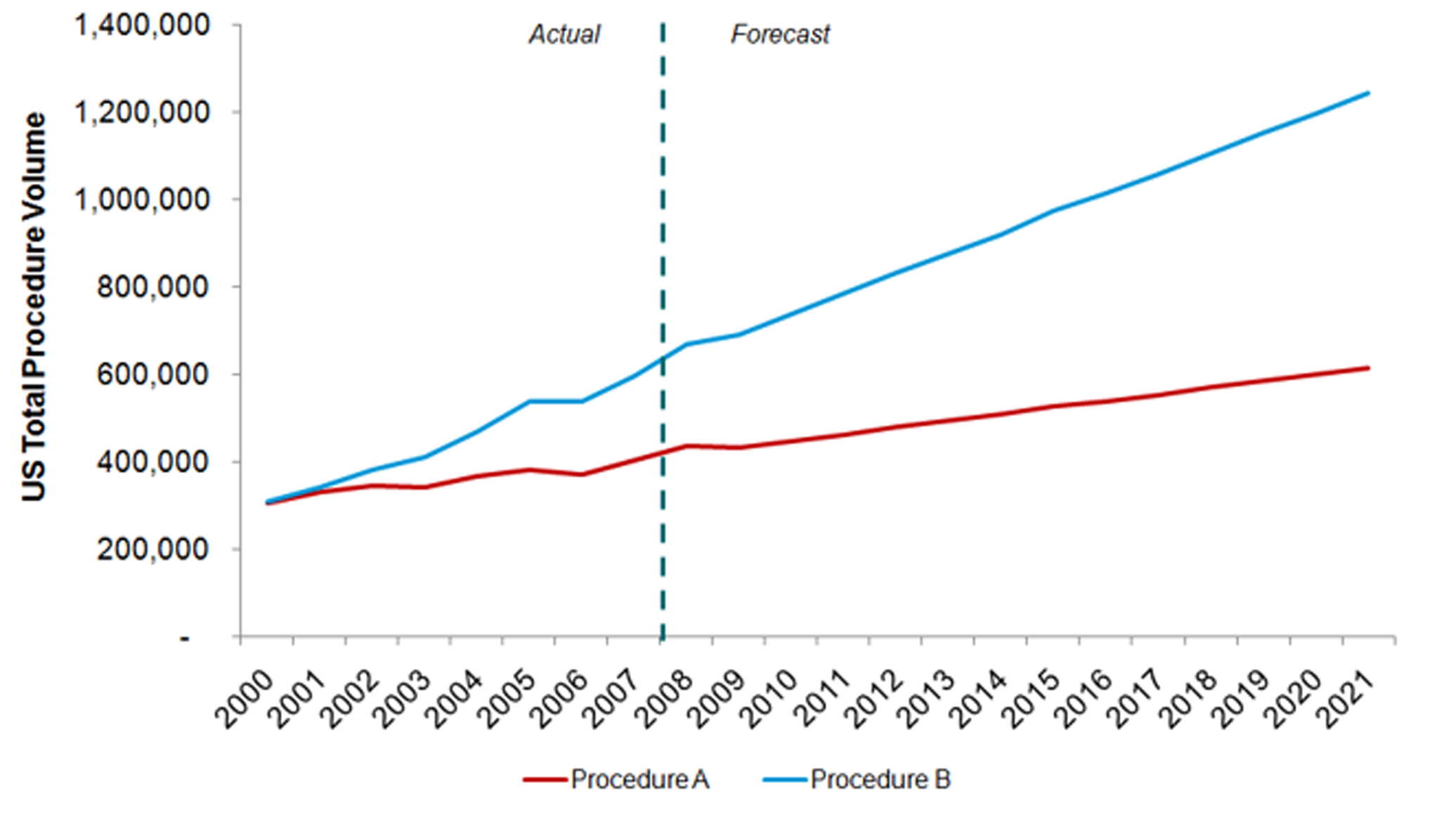

At I2, we provide clear and comprehensible deliverables which highlight the

most relevant and important findings. We incorporate market size, product

adoption, potential market changing events, and other relevant factors to

create comprehensive forecasts that provide the revenue forecasts and NPV

estimates our clients need to be confident in their decisions.

Example: Patient Volumes Analysis

Example: Market Sizing Analysis

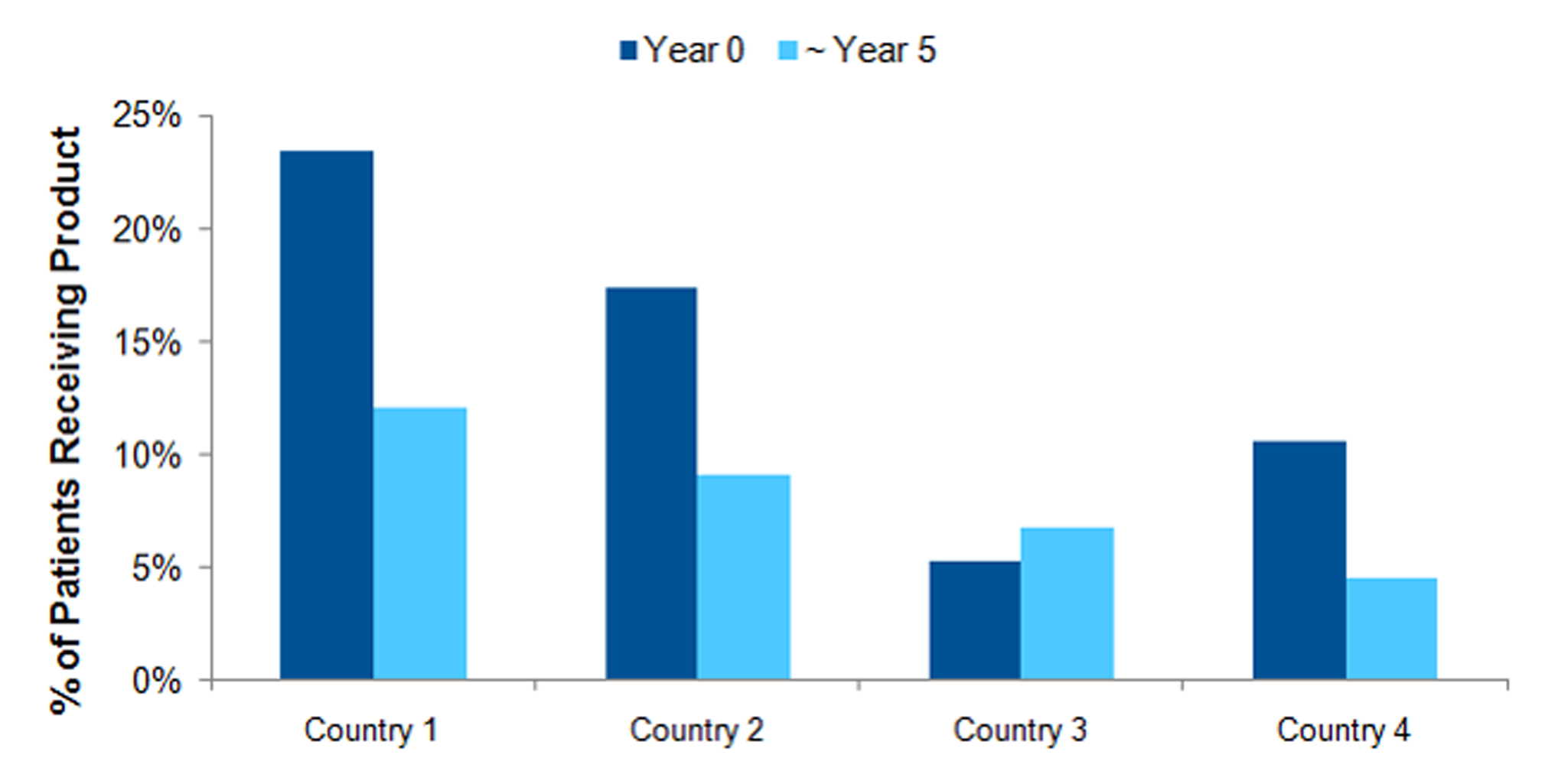

Example: Product Adoption Analysis

Secondary Information Sources

I2 frequently uses secondary information sources to

supplement primary research or for separate

analysis or consulting efforts to meet the wide

range of insights our clients require, including:

| Targeting |

|

| Market Trends |

|

| Market Sizing |

|